Who We Are

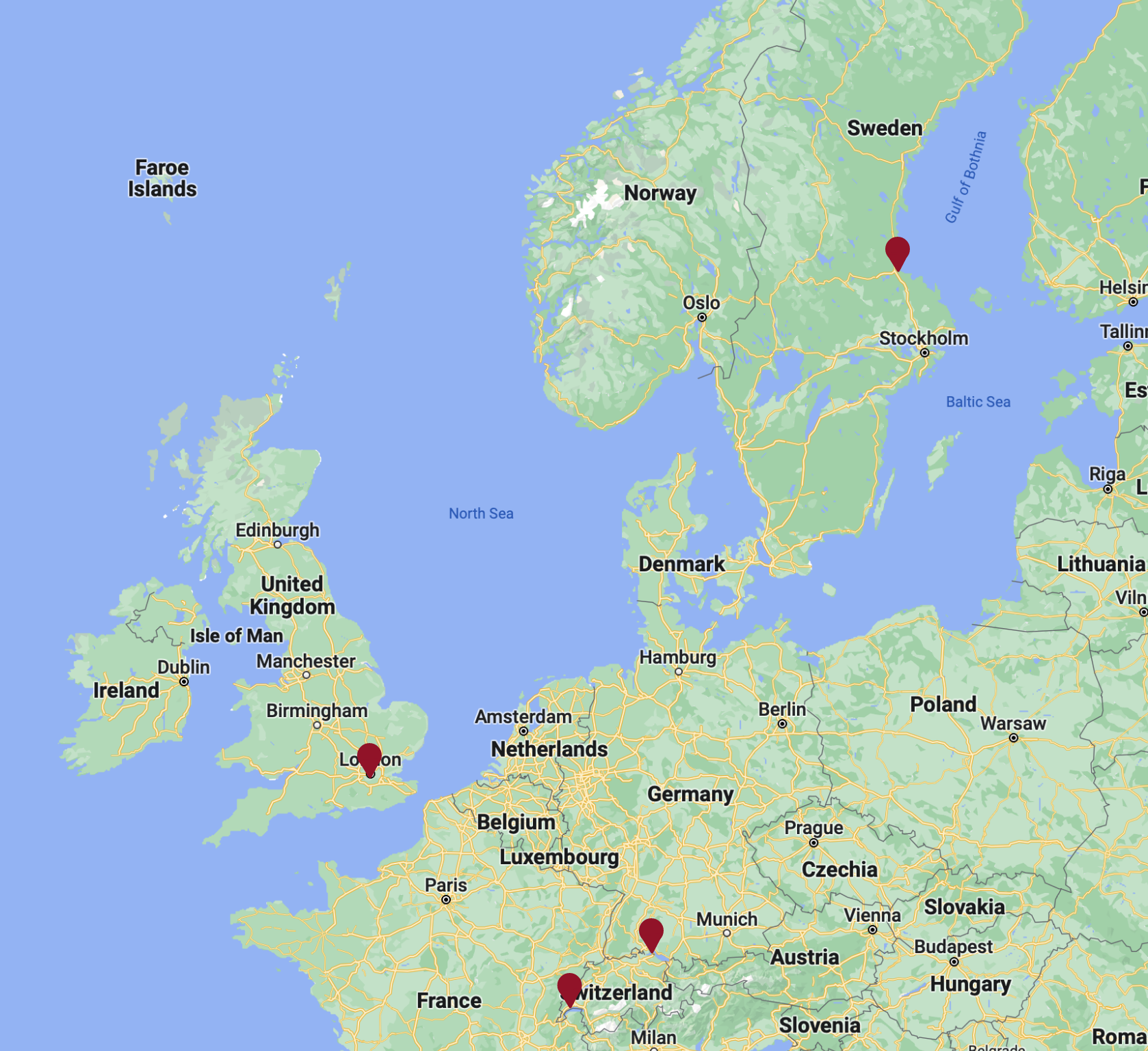

We are the largest boutique tax accounting firm in the UK & Europe specializing in US tax. Established over 35 years ago, we have offices in London, Zurich, Geneva, and the Nordics with expertise in US tax advice, planning, and compliance for individuals, funds, trusts and corporations affected by the US tax system, wherever they may live or operate in the world.

Why Choose Us

We believe there is a better way to do US tax compliance and planning. Our clients can rely on the in-depth, up-to-the-minute, specialized knowledge of our teams, to confidently and expertly navigate the complex and challenging US tax system. We invest in talent and professionalism in a great working environment, to deliver world-class client service.

Our International Reach

With bases in London, Zurich, Geneva and the Nordics, and clients in over 30 countries across the globe, our specialist teams of cross-border advisors include strong, multilingual US tax accountants, UK tax accountants and US attorneys, experienced in the complex and changeable international aspects of the US tax system.

Furthermore, we are members of Geneva Group International (GGI), listed by Accountancy Age as the second biggest global alliance of independent professional firms in the world. GGI unites international, independent audit, accounting, law and consulting firms which can find the right solution to resolve any financial, legal and tax issues which may arise.

Key Divisions

Our size and independence in the US tax market has enabled us to attract talent from industry-leading firms, including the Big Four, and build expert teams, positioned to deliver exceptional client service across our four key specialist divisions:

- Private Client & Individual

- US & UK Tax Services Planning for US-Connected Trusts, Estates & Family Offices

- Funds & Partnerships

- Corporations, US Expansion & FATCA

Our Vision

To be the best boutique tax accounting firm in the UK & Europe.

Our Affiliations

Here to Help

London

3 Harbour Exchange Square

London E14 9GE

United Kingdom

+44 20 7357 8220

Zurich

Brandschenkestrasse 20

CH 8001

Zurich

Switzerland

+41 44 387 8070

Geneva

Rue de Candolle 19

CH 1205

Geneva

Switzerland

+41 22 700 2500

Nordics

Norra Skeppsbron 5B

SE 803 10

Gavle

Sweden